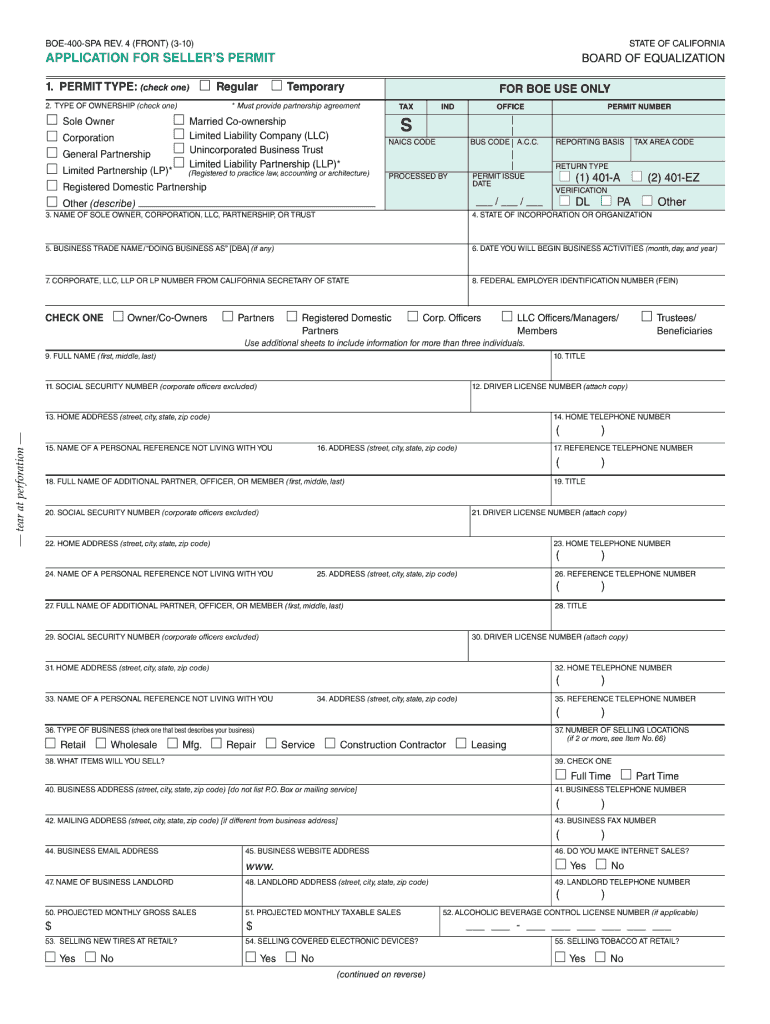

Who needs this application?

It’s a form for individuals, corporations, partnerships and other organizations for obtaining a permit for selling any goods in California. It is issued by the State Board of Equalization. Without this application, and, therefore, the permit, any sale would be illegal. It can result in an administrative penalty or a trial that can lead to even worse consequences.

What is it for?

By filling out this form, any applicant can receive a regular or a temporary seller’s permit. It is a mandatory document for running sales regardless if it’s a one-time-only action or a long-term business activity. This permit allows the holder to sell any tangible property in California.

Is it accompanied by other forms?

This application is submitted with a copy of driver’s license or another ID for the Board to protect itself from fraudulent information.

When is this application due?

You should file this application whenever you’re going to make a sale or start a sales company. If the Board approves your application, you will receive a seller’s permit in about two weeks.

How do I fill out a seller’s permit application?

There are eight pages in this application and six of them are dedicated to instructions and frequently asked questions. After you’ve read them, don’t hesitate to remove them from your completed application. Describe the permit type you apply for in the top box of the first page. After that give general information and contacts about the business owners or an individual who needs to make a sale. Tell about the location, ownership and organizational changes (if any) on page 2. Don’t forget to put the date and your signature.

Where do I send it?

Once you’re done filling out the form, send it to the closest Board of Equalization office in your area. You can check the list of addresses at BOE official website. You can also file the completed form at that website.